By Oren Jacobson, Market Analyst - New Home Star //

Customers are increasingly expressing the concern that they are “buying at the top of market.” The concern raises questions from our sales professionals because they are hearing it come up from customers. The basic concern being elevated is the fear of another market downturn (like the Great Recession specifically) and the risk of buying at the top of the market that's about to crash. So, what’s the answer? Are we in a bubble? Is there a recession coming? Let’s turn to some data to answer that question. As we do, though, let’s remember that those two questions are not the same.

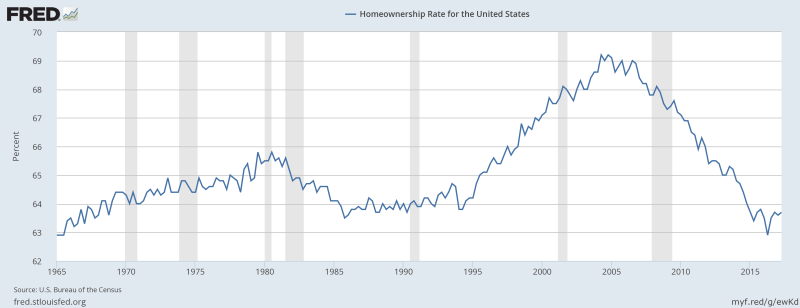

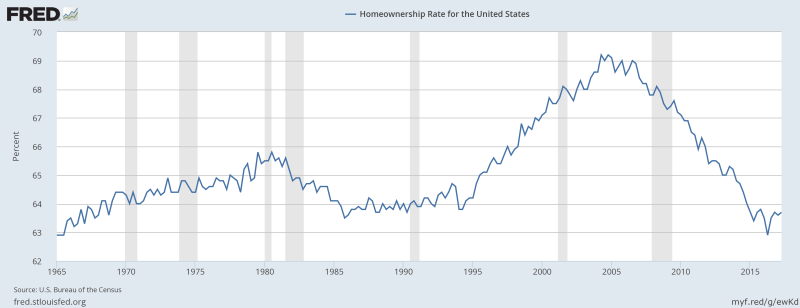

If you want to know what a bubble looks like the graph below is for you. You can literally see the bubble in homeownership rates with the peak near 2007. Note that the gray bars signify a recession. Around 1995, homeownership rates began to dramatically increase to north of 69% before the market crashed. Since then, they’ve come all the way down below pre-1995 levels. This means demand for homeownership is down in the relative sense. Not usually the sign of a housing bubble.

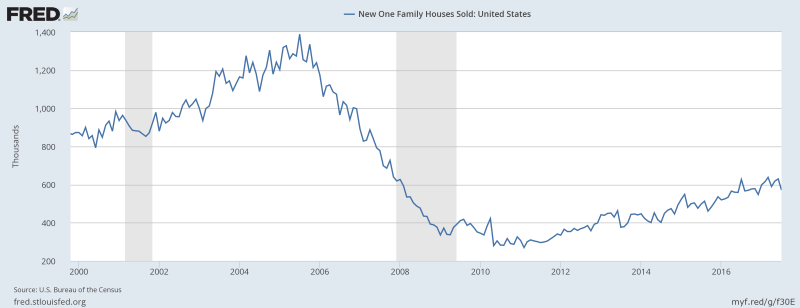

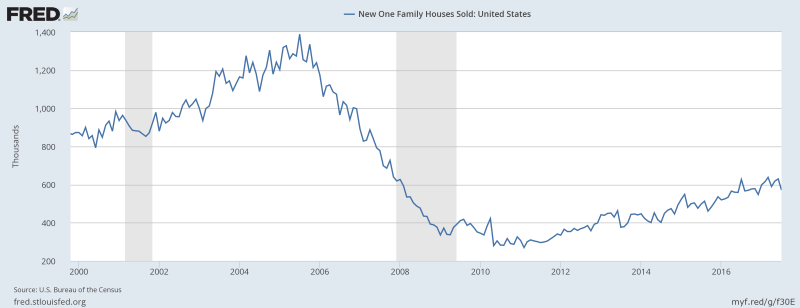

Maybe homeownership isn’t the right metric to look at. Perhaps we should look at new sales? The graph below tells a similar story. New sales are well below their pre-recession peaks. In fact, they’re well below where we were at the turn of the century so we know we don’t have new home demand spiking even as it is climbing.

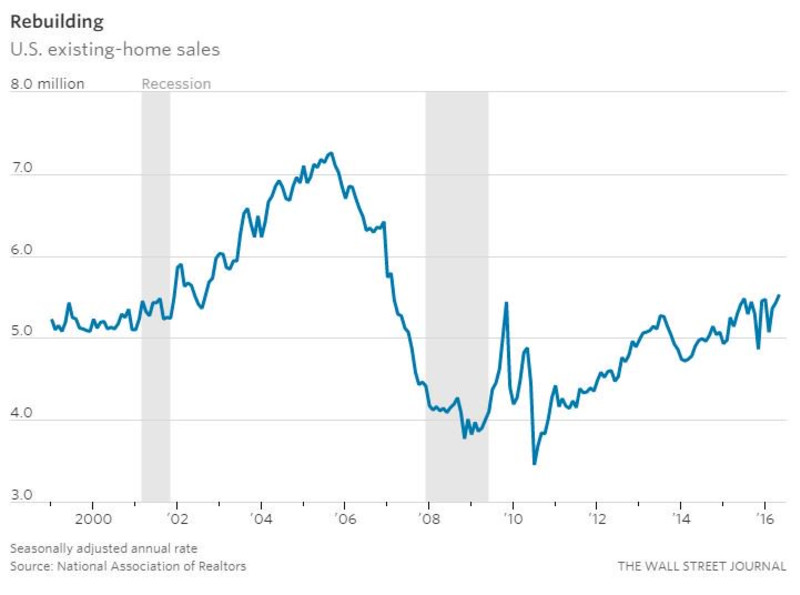

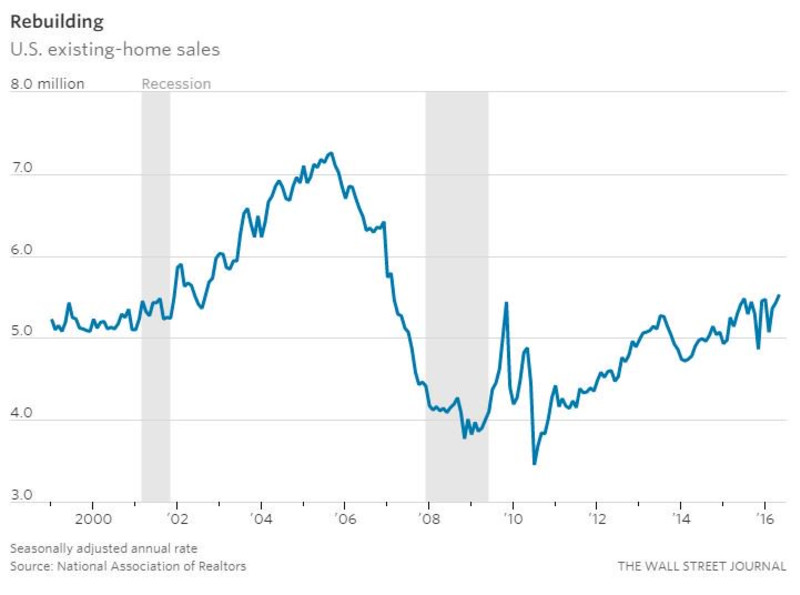

Perhaps, we ought to take a look at the resale side of the market instead. Maybe that will shed some more light on this? Is it possible we have increased demand and we just have consumers preferring existing over new in greater numbers? Again, we see that overall market activity is still well lower than before the recession and overall activity is near the long run trend line.

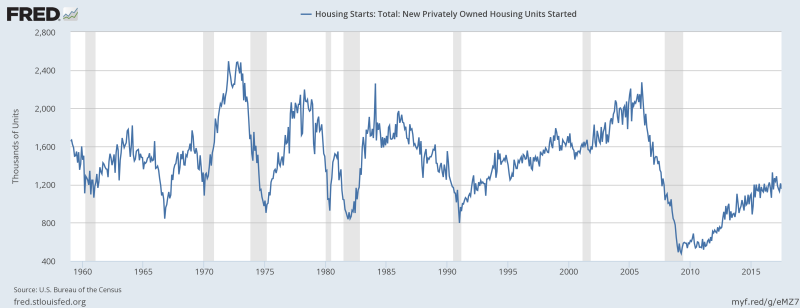

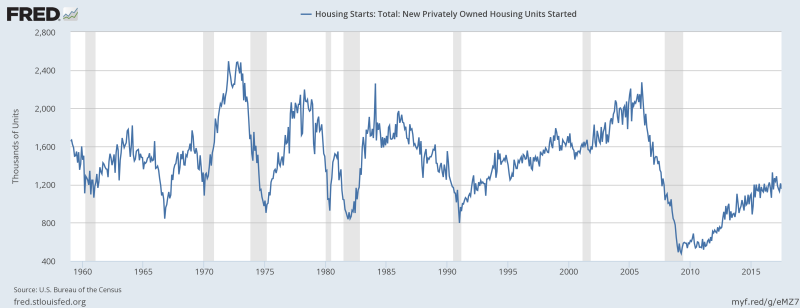

There is one other data point that I think is really important to explore. The reason the pain of the housing crisis and recession was so great wasn’t simply because of traditional recessionary effects. It was the contagion of the interconnected financial markets hitting us while we had dramatically high levels of supply on market. When the economy locked up, we were at record highs in supply. When supply outpaces demand (badly) the only way to absorb that supply is for prices to fall (dramatically). This obviously took many years to clean up.

Looking then at housing starts (new construction supply) is also necessary then. What the graph below shows you is that housing starts are well below the pre-recession level and actually below the long run trend line averages since 1960.

So what does this all mean? It means we aren’t in a bubble. The circumstances that surrounded the housing crisis and the subsequent steep decline in housing value simply aren’t there. Now, there is always the possibility of an unforeseen shock, even a catastrophic one. So long as overall demand levels are still relatively low and homeownership rates and new starts are below long term average trend lines we can reasonably answer the “bubble” question in the negative.

However, that doesn’t mean we may not have a recession. What it does mean is that a recession isn’t likely to cause the same type of pain that people are trying to avoid (and the pain and memory driving this question).

The truth is we’ve had a long run of positive economic growth. It has been slow and steady. Its gains have been distributed and isolated by income and geographic boundaries. However, we have had years and years of consecutive growth. The natural business cycle would suggest that you would have some type of recession or correction soon.

There are some policy options to delay a recession, though. We’ve talked multiple times this year about tax reform and infrastructure spending as a way to spur growth. They would act as a stimulant in the short term that would likely fight off traditional business cycle trends. It’s clear now, though, that infrastructure isn’t happening this year and tax reform is a 50/50 bet. If neither happens this year and the markets don’t believe they will happen in an election year (2018), then you could see a correction (recession) as a result. Why? Stock prices have soared this year based on these expectations. If the expectations aren't met investors may sell off in anticipation of (or causing) a correction/recession.

The key to remember, though, is that a normal recession doesn’t cause the type of pain your customers are concerned about. And, if a customer is going to be purchasing a long term home, they shouldn’t worry about it anyway. Look at how much prices have rebounded since 2008. If they play the long game they’re likely to end up fine. If they're only going to be in a home for a couple years though, or if they have reason to worry about their job, then it's our responsibility to advise caution.